Managing your money wisely in 2026 requires understanding the unique financial landscape we’re facing. With Federal Reserve rate cuts continuing, major tax changes from the One Big Beautiful Bill Act now in effect, and economic uncertainty affecting household budgets nationwide, having the right financial tips for 2026 has never been more critical. Whether you’re looking to save more, invest smarter, reduce debt, or simply gain control over your finances, these proven financial tips 2026 strategies will help you achieve your money goals.

This comprehensive guide provides actionable personal finance tips for 2026 that combine timeless money management wisdom with strategies specifically tailored to today’s economic conditions. From high-yield savings accounts to retirement planning, budgeting strategies to investment optimization, you’ll discover everything you need to build lasting financial security with these essential financial tips 2026.

1. Lock In High-Yield Savings Rates Before Interest Rates Drop Further – Essential Financial Tips 2026

Why This Financial Tip Matters Most in 2026

One of the most important money moves you need to make right now involves your emergency fund and short-term savings. According to the Federal Reserve’s latest policy announcements, the central bank cut interest rates by 0.25 percentage points in December 2025, marking its third consecutive cut of the year. Financial experts predict additional rate cuts ahead, with futures market activity showing roughly 56% probability of two or fewer rate movements throughout 2026.

What does this mean for your personal finances? The attractive annual percentage yields around 4% that online banks currently offer on high-yield savings accounts and certificates of deposit are already declining and will likely drop further throughout the year. This makes securing high-yield savings one of the top financial tips 2026 experts recommend. Savers may see rates decline to about 3% on most short-term products by year end, according to Bankrate’s rate forecast analysis.

Smart Savings Strategies: Action Steps You Need to Take Now

Financial planning experts agree this is one of the top financial tips for 2026: if you’re going to open a high-yield savings account or CD, do it sooner rather than later. According to NerdWallet’s savings account comparison, online banks are still offering competitive rates, but windows are closing fast. Here’s your money management game plan:

Open a High-Yield Savings Account Immediately – If your emergency fund sits in a traditional bank account earning virtually nothing, move it to a high-yield savings account today. While rates will decline, 3% remains significantly better than the 0.01% most traditional banks offer. Compare online banks like Marcus by Goldman Sachs, Ally Bank, and American Express Personal Savings for competitive rates.

Consider CD Laddering Strategy – Certificate of deposit laddering involves opening multiple CDs with different maturity dates. For example, you might allocate funds into 6-month, 1-year, 2-year, and 3-year CDs. This personal finance strategy locks in current rates on portions of your savings while maintaining flexibility as interest rates change.

Build Your Emergency Fund – Financial advisors typically recommend saving three to six months of expenses for unexpected costs like medical bills, car repairs, or sudden income loss. According to a TD Bank Financial Preparedness Survey, nearly three in four respondents have been impacted by unexpected bills, with 59% going into debt and half reallocating budget or savings. Building an emergency fund is among the most critical financial tips 2026 experts emphasize.

Start with achievable financial goals like $1,000 or $2,000, then gradually work toward the full three to six months of living expenses. The Consumer Financial Protection Bureau offers excellent resources on building emergency savings. Automate your savings by setting up transfers from checking to savings every payday, treating it like a non-negotiable bill payment.

Compare Online Banking Options – Don’t settle for the first account you find. Online financial institutions typically offer better interest rates than traditional brick-and-mortar banks due to lower overhead costs. Spend 30 minutes comparing rates and terms to maximize returns on your money.

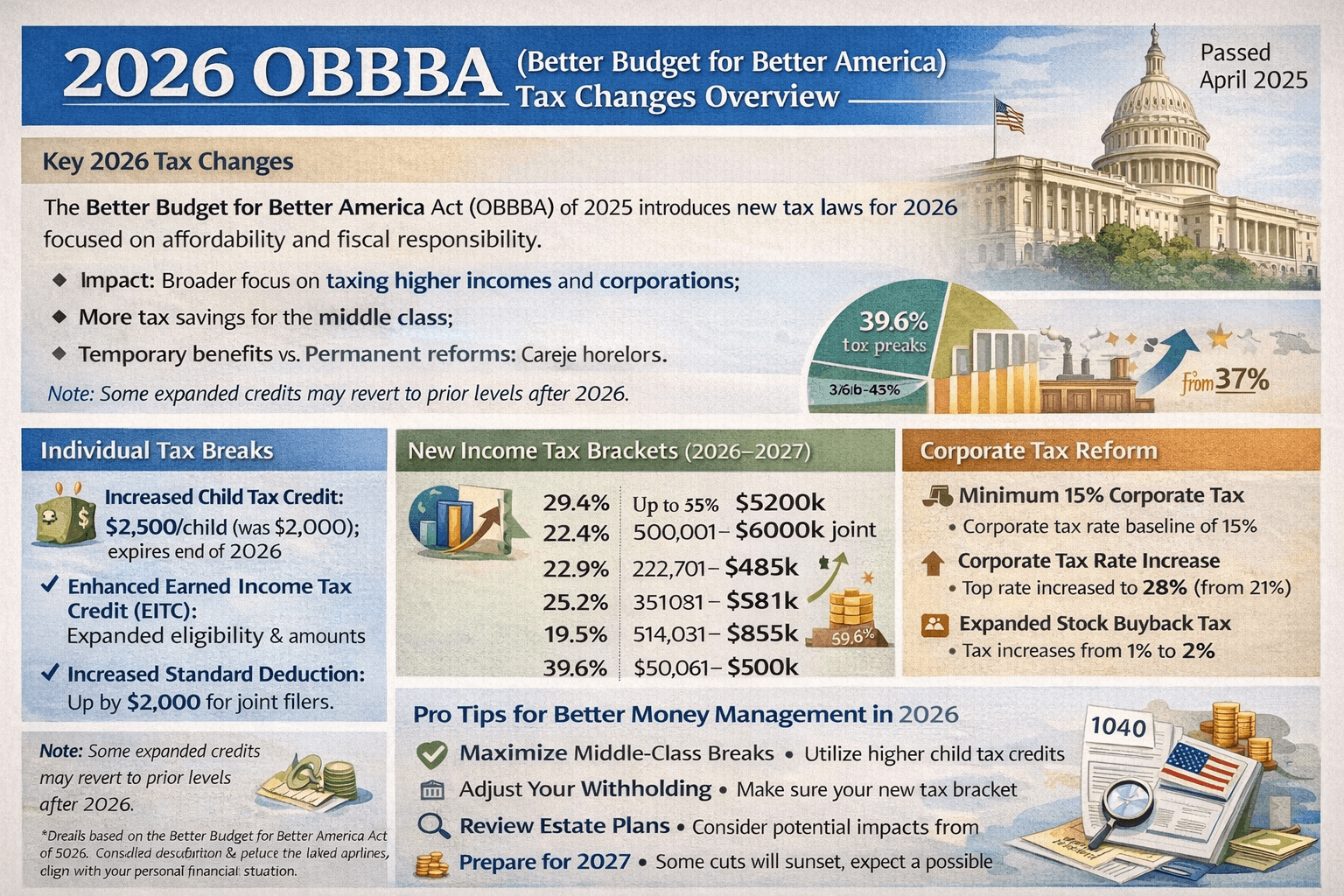

2. Navigate the Major Tax Changes from OBBBA for Maximum Savings – Critical Financial Tips 2026

Understanding the Biggest Tax Law Changes Since 2017

The One Big Beautiful Bill Act, signed into law in July 2025, represents the most significant federal tax changes since 2017. While many provisions preserve existing tax rates, several new changes taking effect in 2026 could significantly impact your tax liability. Understanding these changes is one of the most important financial tips 2026 tax professionals recommend. This financial tip could save you thousands in taxes if you understand and leverage these changes properly.

The lower tax rates created by the TCJA were set to sunset at year end 2025, but OBBBA made those amounts permanent, preventing tax increases for almost all taxpayers in 2026. However, the law also introduced new limitations and opportunities essential to your financial planning. For detailed tax information, visit the IRS official website.

Key Tax Law Changes You Must Know for Smart Financial Planning

Expanded Standard Deduction – For 2026, the standard deduction increases to $16,000 for single or married filing separately filers and $32,000 for married filing jointly and surviving spouses, with inflation adjustments thereafter. This simplifies tax filing for many Americans who won’t need to itemize deductions.

Senior Bonus Deduction – For tax years 2025 through 2028, taxpayers age 65 and older can claim a temporary deduction up to $6,000, or $12,000 for joint filers. This above-the-line deduction is available regardless of whether you take the standard deduction or itemize, though income-based limitations apply.

Dramatically Increased SALT Deduction – One of the most significant personal finance changes affects high-tax state residents. The state and local tax deduction cap increases from $10,000 to $40,400 in 2026, though taxpayers with modified adjusted gross income exceeding $500,000 see reductions.

Charitable Contribution Changes – Starting in 2026, charitable giving becomes more complex. For taxpayers who itemize deductions, contributions are deductible only when they exceed 0.5% of adjusted gross income. However, non-itemizers can claim donation deductions up to $1,000 for single filers or $2,000 for joint filers, though donations to donor-advised funds or private foundations don’t qualify.

Increased Child Tax Credit – The child tax credit increased from $2,000 to $2,200 per child in 2025 and will be indexed to inflation starting in 2026, providing families with additional tax savings for better financial planning.

Higher Estate Tax Exemption – Federal estate, gift, and generation-skipping transfer tax exemptions permanently increased to $15 million per taxpayer, or $30 million per married couple with portability, adjusted annually for inflation starting in 2027.

Tax Planning Action Steps for 2026

Review Your Tax Withholding – With these tax changes, your liability for 2026 may differ significantly from previous years. Review your W-4 form and adjust withholding if necessary to avoid surprise tax bills or unnecessarily large refunds next April.

Reconsider Itemizing vs Standard Deduction – The increased SALT cap means more taxpayers, especially in high-tax states, should evaluate whether itemizing makes financial sense. Run calculations both ways or consult a tax professional for personalized financial advice.

Maximize Charitable Giving Strategically – If you itemize and charitable contributions are close to the 0.5% AGI floor, consider bunching several years of donations into 2026 to exceed the threshold. Alternatively, if you don’t itemize, remember you can still claim up to $1,000 ($2,000 if married) for cash donations.

Seniors Should Calculate the Bonus Deduction – If you’re 65 or older, determine qualification for the temporary senior deduction. This could significantly reduce taxable income, affecting decisions about IRA withdrawals, Social Security withholding, and estimated tax payments.

3. Master Smart Budgeting Strategies in an Uncertain Economy – Essential Financial Tips 2026

Why Budgeting Matters More Than Ever for Financial Success

With inflation still above the Federal Reserve’s 2% target and economic growth expected to moderate, having a solid budget isn’t just about saving money—it’s about maintaining financial stability during uncertain times. About one in three Americans thinks their finances are likely to worsen in 2026, the highest share since Bankrate began tracking sentiment in 2018. This makes budgeting one of the fundamental financial tips 2026 that every household needs.

The good news? You don’t need complicated spreadsheets or restrictive budgets leaving you feeling deprived. The key is creating a realistic budget matching your actual spending patterns and lifestyle—one of the most fundamental personal finance tips. Investopedia’s budgeting guide offers excellent resources for getting started.

The 50/30/20 Rule: Your Foundation for Financial Success

Financial professionals recommend the 50/30/20 budgeting rule, which allocates half of take-home pay to essentials, one-third to lifestyle expenses, and 20% to financial goals such as paying off debt or saving for vacations. This framework provides flexibility for most households while offering clear spending guidelines.

50% for Needs – This includes housing (rent or mortgage, property taxes, insurance), utilities, groceries, transportation, minimum loan payments, and insurance premiums. If essential expenses exceed 50%, look for areas to reduce costs, such as downsizing housing, refinancing loans, or reducing transportation expenses.

30% for Wants – This covers discretionary spending like dining out, entertainment, hobbies, streaming services, gym memberships, and vacations. This category offers the most opportunities for savings when budgets get tight.

20% for Savings and Debt Repayment – This includes emergency fund contributions, retirement savings, extra debt payments above minimums, and saving for specific financial goals like down payments or vacations. If you’re behind on this percentage, gradually increase it by finding ways to reduce wants or optimize needs.

Modern Budgeting Tools for Better Money Management

Budgeting apps make expense tracking easier by automatically categorizing expenses and alerting you to unusual charges, helping you stay on top of money without extra effort. These tools are essential components of our financial tips 2026 recommendations. Popular free and low-cost personal finance options include:

- PocketGuard – Uses income, recurring expenses, and savings goals to determine available everyday spending, perfect for people wanting simple answers to “how much can I spend right now?”

- YNAB (You Need A Budget) – Best for zero-based budgeting where every dollar has a job. Visit YNAB to learn more

- Mint – Comprehensive free tool tracking spending, bills, investments, and credit scores from Intuit Mint

- EveryDollar – Simple interface for tracking income and expenses from Ramsey Solutions

- Monarch – Clean interface with expense tracking, budgeting, and financial health visualization for $8.33 monthly

Action Steps for Better Budget Management

Track Everything for 30 Days – Before creating budgets, spend one month tracking every single expense. This awareness often reveals shocking spending patterns, such as forgotten subscriptions, excessive dining out, or small daily purchases adding up quickly.

Identify Your Budget Leaks – Review bank and credit card statements for the past few months. Look for recurring charges you don’t recognize or no longer use. Streaming services, subscription boxes, unused gym memberships, and app subscriptions are common culprits.

Automate Your Financial Life – Set up automatic transfers to savings accounts, automatic bill payments to avoid late fees, and automatic investments to retirement accounts. Automation removes willpower from the equation, ensuring financial priorities happen before discretionary spending.

Build in Irregular Expenses – One of the biggest budget killers is failing to plan for annual or semi-annual expenses like insurance premiums, property taxes, holiday gifts, back-to-school shopping, and car maintenance. Calculate yearly costs, divide by 12, and set aside that amount monthly in separate savings accounts.

Review and Adjust Monthly – Your budget should evolve with your life. Schedule monthly 30-minute money meetings with yourself (or your partner) to review spending, celebrate wins, and adjust categories as needed.

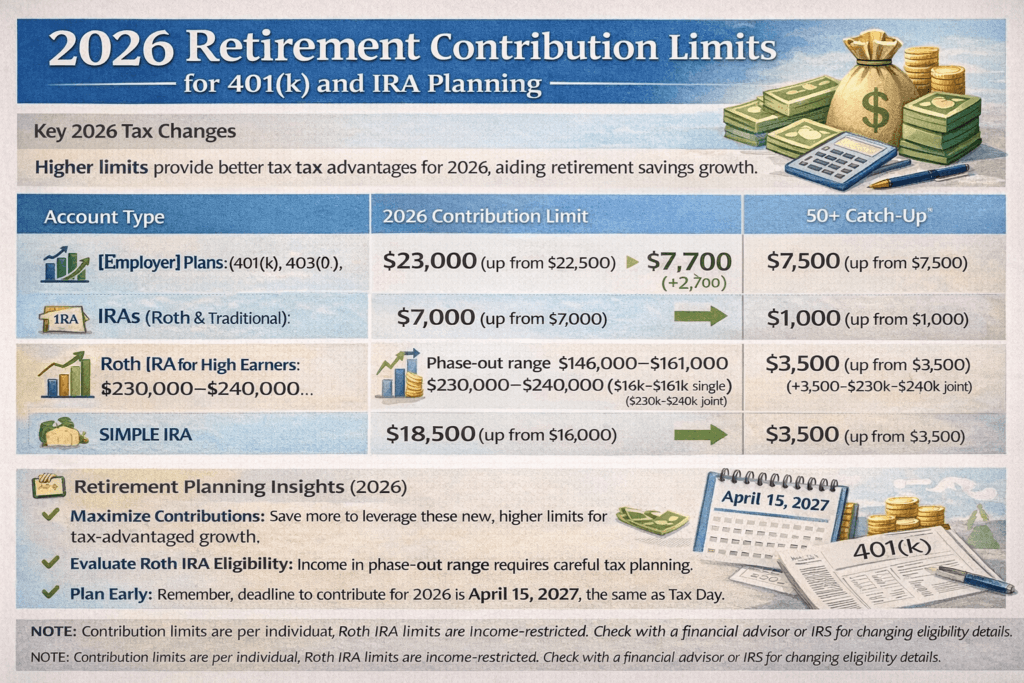

4. Supercharge Your Retirement Savings with Higher Contribution Limits – Crucial Financial Tips 2026

2026 Brings Bigger Opportunities for Retirement Planning

Retirement savings got significant boosts for 2026, with contribution limits increasing across multiple account types. These changes represent real opportunities to accelerate retirement savings and reduce current tax burdens—essential financial planning tips for 2026 that build long-term wealth. The Social Security Administration and Department of Labor provide comprehensive retirement planning resources.

Know Your New Retirement Contribution Limits

For 2026, 401(k) plans allow contributions of $24,500, with an additional $8,000 catch-up contribution if you are 50 or older. That’s a total potential contribution of $32,500 for those eligible for catch-up contributions. Understanding these limits is one of the key financial tips 2026 for retirement savers.

IRA limits increase to $7,500, with an additional $1,100 catch-up contribution if you are 50 or older, bringing total possible IRA contributions to $8,600 for those age 50 and above. Fidelity’s retirement planning tools can help you calculate your retirement needs.

These increases help Americans catch up on retirement savings, especially important given longer life expectancies and concerns about Social Security’s long-term viability.

Action Steps to Maximize Retirement Savings and Build Wealth

Get the Full Employer Match – If your company matches employee 401(k) contributions, aim to contribute at least enough to receive the full match. This is literally free money providing immediate 50% to 100% returns on contributions, depending on your employer’s matching formula.

Increase Your Contribution Rate – If you received raises, bonuses, or tax refunds, consider increasing retirement contributions. Even 1% increases in contribution rates make substantial differences over time due to compound growth.

Follow a Priority List for Extra Money – When you have extra income, follow this financial priority list: contribute to emergency funds first; if you already have three to six months of living expenses saved, pay off credit card debt; then contribute more to retirement accounts.

Don’t Overthink Investment Choices – For retirement accounts, consider index funds, which are diversified groups of stocks. Vanguard’s investment education resources provide excellent guidance on passive investing strategies. Target-date funds are another excellent hands-off option automatically adjusting asset allocation as you approach retirement, making this one of the smartest financial tips 2026 for hands-off investors.

Take Advantage of Roth Options – Many 401(k) plans now offer Roth options where contributions are made after-tax but withdrawals in retirement are tax-free. If your employer offers this and you expect higher tax brackets in retirement, or value tax-free retirement income, consider splitting contributions between traditional and Roth accounts.

Catch-Up Contributions Are Crucial – If you’re 50 or older, those catch-up contributions aren’t optional—they’re essential financial planning tools. Many Americans are behind on retirement savings, and these extra contribution limits give you chances to accelerate progress during peak earning years.

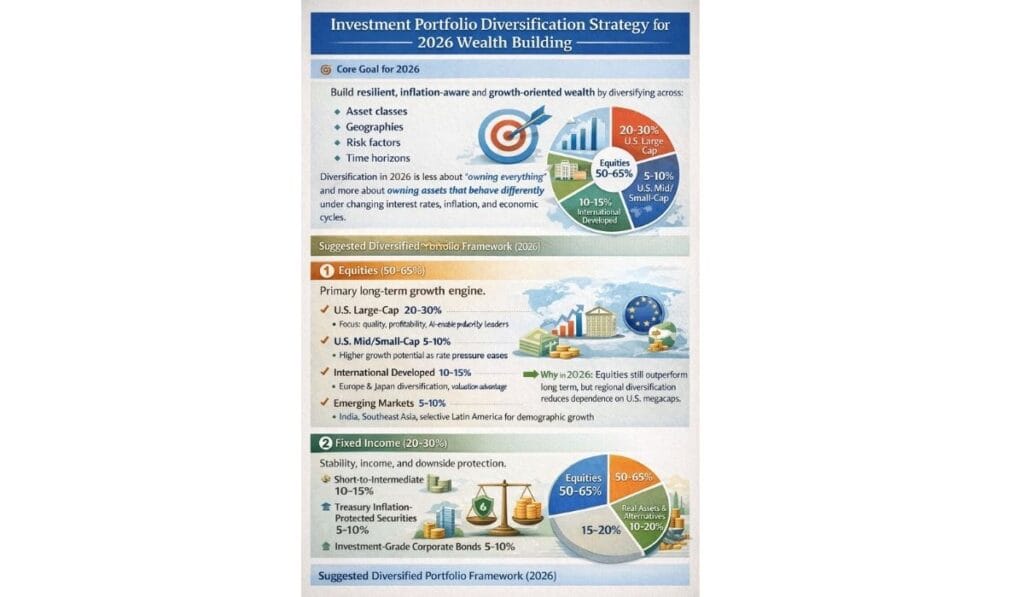

5. Optimize Your Investment Strategy for a Changing Rate Environment – Strategic Financial Tips 2026

Understanding the Investment Landscape for 2026

The financial landscape is shifting fast, with interest rates easing, AI moving from buzzword to everyday tool, and new tax rules on the horizon. For investors, this changing environment requires both vigilance and strategic thinking—key financial tips 2026 for building wealth. Morningstar’s investment research provides valuable market insights and analysis.

A new Federal Reserve Chair will likely be selected as Jerome Powell’s term expires on May 15, 2026, and the Fed may seek to cut interest rates one or two times to bring overnight rates closer to the 3% to 3.25% range. These rate movements affect everything from bond values to stock market performance to real estate prices. CNBC’s financial news provides up-to-date market coverage.

Key Investment Considerations for Smart Money Management

Rebalance Your Portfolio – Market movements over the past year may have shifted asset allocation away from targets. Periodically rebalancing portfolios is important, particularly if market volatility has caused investments to stray from target allocations. Review your mix of stocks, bonds, and other assets to ensure they align with risk tolerance and time horizons.

Consider Your Timeline and Risk Tolerance – As you near retirement, consider shifting toward more conservative asset allocations with greater exposure to bonds and other typically stable assets to help reduce risk and preserve capital. However, with people living longer, even retirees need some growth-oriented investments to combat inflation over 20-30 year retirements.

Don’t Try to Time the Market – One of the biggest investment mistakes is attempting to time market tops and bottoms. Research consistently shows time in the market beats timing the market. Stay invested according to your plan and ignore short-term market noise.

Take Advantage of Lower Borrowing Costs – Lower mortgage and loan rates could create opportunities to refinance or buy with confidence. If you’ve been considering refinancing mortgages, taking out home equity loans for improvements, or financing major purchases, declining rates may present favorable opportunities.

Be Aware of Reinvestment Risk – Falling rates can increase reinvestment risk and impact bond returns. As bonds mature or CDs come due, you’ll be reinvesting at lower rates than previously enjoyed. This makes diversified investment strategies that aren’t overly dependent on fixed-income yields even more important.

Action Steps for Investment Success and Wealth Building

Review Your Asset Allocation Annually – Schedule annual portfolio reviews, ideally at the same time each year. Assess whether current mixes of stocks, bonds, cash, and other investments still match goals, time horizons, and risk tolerance.

Maintain a Diversified Portfolio – Don’t put all eggs in one basket. Diversification across asset classes, sectors, and geographies helps protect portfolios from concentrated risks. Index funds and ETFs make diversification easy and affordable. Charles Schwab’s portfolio guidance offers tools for building diversified investment strategies, making this one of the essential financial tips 2026 investors need.

Keep Costs Low – Investment fees compound negatively over time, eating into returns. Favor low-cost index funds and ETFs over actively managed funds with high expense ratios. Even 1% differences in annual fees can cost tens of thousands over 30-year investment horizons.

Stay the Course During Volatility – Markets will fluctuate—that’s guaranteed. What’s also guaranteed is that emotional decisions during market downturns are usually wrong. Develop investment policy statements outlining strategies and refer back to them when tempted to make impulsive changes.

Consider Professional Financial Advice – If managing investments feels overwhelming, consider working with fee-only fiduciary financial advisors legally obligated to act in your best interest. Peace of mind and strategic guidance can be worth the cost, especially for complex financial situations.

Bonus Financial Tips for Success in 2026

Strengthen Your Financial Security

Upgrade Your Cybersecurity – High-profile data breaches, including one at TransUnion this year and Medicare last year, highlight needs to improve security of online accounts by using hard-to-guess passwords and changing them regularly. Use password managers, enable two-factor authentication on all financial accounts, and never reuse passwords across multiple sites.

Review Your Insurance Coverage – As your life changes, so do insurance needs. Review life, disability, health, auto, and homeowners insurance annually to ensure adequate coverage without paying for unnecessary extras.

Create or Update Your Estate Plan – If you’ve acquired assets over time, even just homes and some savings, you have an estate. Make sure you have updated wills, healthcare proxies, powers of attorney, and beneficiary designations on all accounts. With increased estate tax exemptions, fewer families will face estate taxes, but everyone still needs basic estate planning documents.

Get Your Family Involved in Financial Planning – Financial success isn’t a solo endeavor. If you’re married or have partners, hold regular money meetings to discuss goals, review spending, and make financial decisions together. Looking at money in the most neutral way possible and figuring out what you’re going to do to fix things that aren’t working helps remove shame and anxiety from financial conversations.

Invest in Your Financial Education – The financial landscape constantly evolves. Dedicate time to improving financial literacy through books, podcasts, courses, and trusted financial websites. The more you understand, the better financial decisions you’ll make.

Make 2026 Your Best Financial Year Yet

Financial success doesn’t require perfect execution or getting rich quick—it requires consistent, informed action on fundamentals. By implementing these five core strategies—securing high-yield savings before rates fall further, understanding and leveraging new tax changes, maintaining realistic budgets, maximizing retirement contributions, and optimizing investment strategies—you’ll be well-positioned for financial success not just in 2026, but for decades to come. These financial tips 2026 strategies form the foundation of lasting wealth.

Start with the area that will have biggest impacts on your finances. For some, that’s building emergency funds. For others, it’s taking advantage of tax strategies or increasing retirement contributions. Pick one or two priorities from these financial tips 2026 recommendations, take action this week, and build momentum from there.

Remember, most Americans accomplish at least some of their annual resolutions. The key is starting with realistic financial goals and creating systems supporting long-term success. Your financial future is built one smart decision at a time, and following these financial tips 2026 is the perfect way to build stronger financial foundations.

Your 2026 Financial Action Plan: Getting Started Today

The difference between financial success and struggle often comes down to taking first steps. Here’s a practical 30-day action plan to implement these five financial tips and transform your financial future:

Week 1: Assess and Secure

- Day 1-2: Calculate net worth by listing all assets and liabilities

- Day 3-4: Research and open high-yield savings accounts with best current rates

- Day 5-7: Set up automatic transfers to new savings accounts (start with even $25-50 per paycheck)

Week 2: Tax Planning and Budgeting

- Day 8-9: Review OBBBA tax changes and determine which ones affect you

- Day 10-11: Adjust W-4 withholding if needed based on new tax laws

- Day 12-14: Track every expense for these days to understand spending patterns

Week 3: Retirement and Debt Strategy

- Day 15-16: Log into 401(k) and review current contribution rates

- Day 17-18: Increase retirement contributions by at least 1% if possible

- Day 19-21: List all debts with interest rates and create payoff priority plans

Week 4: Optimize and Protect

- Day 22-23: Review investment allocations and rebalance if needed

- Day 24-25: Audit all subscriptions and cancel unused services

- Day 26-28: Review insurance policies for adequate coverage

- Day 29-30: Schedule monthly money review meetings for next month

Common Financial Mistakes to Avoid in 2026

Even with the best intentions, certain financial pitfalls can derail progress. Here are the most common mistakes to watch out for:

Waiting for the “Perfect Time” to Start Saving There’s never a perfect time to begin saving or investing. Whether rates are high or low, markets are up or down, the best time to start is now. Waiting costs you the power of compound growth.

Ignoring Inflation in Your Financial Planning While inflation has cooled from 2022 peaks, it remains above the Fed’s 2% target. Savings and investment strategies must account for inflation’s erosion of purchasing power. Money sitting in traditional savings accounts earning 0.01% is losing value every year.

Overlooking Small Recurring Charges Subscription services costing just $10-15 monthly seem insignificant, but five or six total $600-900 annually. Review all recurring charges quarterly and eliminate anything you’re not actively using.

Failing to Update Beneficiaries Life changes like marriage, divorce, birth of children, or death of designated beneficiaries require updating beneficiary designations on retirement accounts, life insurance, and other financial accounts. Outdated beneficiaries can create legal nightmares and unintended consequences.

Making Emotional Investment Decisions Selling stocks during market downturns or buying at peaks based on fear or greed typically results in poor returns. Stick to investment plans regardless of short-term market movements.

Not Reading the Fine Print Whether it’s new credit cards, loan agreements, or investment products, always read terms and conditions. Hidden fees, variable rates, and restrictive clauses can cost thousands over time.

Neglecting Financial Education The financial world evolves constantly. Tax laws change, new investment products emerge, and economic conditions shift. Dedicating even 30 minutes weekly to financial education pays enormous dividends through better decision-making.

The Psychology of Money: Building Habits That Last

Financial success isn’t just about knowledge—it’s about behavior. Understanding psychological aspects of money management helps you build sustainable habits:

Automate to Remove Temptation Research shows willpower is a limited resource depleting throughout the day. Don’t rely on willpower to save money or pay bills on time. Automate these actions so they happen before you can spend money elsewhere.

Use Mental Accounting Strategically While all money is technically the same, mentally separating funds into categories (emergency fund, vacation savings, retirement) makes you less likely to raid one category for another. Use separate savings accounts with specific names to reinforce these mental boundaries.

Practice Mindful Spending Before any non-essential purchase, implement 24-48 hour waiting periods. This simple pause eliminates impulse buying and ensures purchases align with values and priorities. Ask yourself: “Will this matter in a week? A month? A year?”

Celebrate Small Wins Financial progress can feel slow, especially when paying off large debts or building significant savings. Celebrate milestones along the way—paying off credit cards, reaching first $1,000 in savings, or sticking to budgets for three consecutive months. These celebrations reinforce positive behavior and maintain motivation.

Reframe Your Relationship with Money Instead of viewing budgeting as restrictive, see it as a tool for spending money on what truly matters to you. Rather than feeling deprived when you don’t buy something, feel empowered by choosing to allocate that money toward your goals.

Building Multiple Income Streams in 2026

In uncertain economic environments, relying solely on single income sources creates vulnerability. Consider diversifying income:

Side Hustles and Freelancing The gig economy continues expanding, offering opportunities to monetize skills, hobbies, and expertise. Platforms like Upwork, Fiverr, and TaskRabbit connect freelancers with clients. Even earning extra $200-500 monthly can accelerate debt payoff or boost savings significantly.

Passive Income Opportunities Dividend-paying stocks, rental properties, peer-to-peer lending, or creating digital products (courses, ebooks, templates) can generate income with minimal ongoing effort once established.

Skill Development for Career Advancement Investing in yourself through education, certifications, or skill development often provides highest returns on investment. Promotions or career changes can increase primary income far more than any side hustle.

Strategic Career Moves With job markets remaining competitive in many sectors, 2026 may present opportunities for strategic career moves. Research shows changing jobs often results in larger salary increases than staying with same employers.

Teaching Financial Literacy to the Next Generation

If you have children or work with young people, passing on financial knowledge is one of the most valuable gifts you can give:

Start Early with Age-Appropriate Lessons Even young children can learn basic concepts like saving, spending, and sharing. Use clear jars to show money accumulating rather than hidden in bank accounts. As they get older, introduce concepts like compound interest, budgeting, and investing.

Give Them Real Financial Responsibility Consider commission-based allowances tied to completing chores, teaching that money is earned through work. Help teenagers open first bank accounts, use debit cards responsibly, and understand bank statements.

Model Good Financial Behavior Children learn more from what you do than what you say. Let them see you comparing prices, using coupons, saving for goals, and making thoughtful spending decisions. Share age-appropriate financial challenges your family faces and how you’re addressing them.

Teach Them About Credit Responsibly Before they’re bombarded with credit card offers in college, ensure they understand how credit works, dangers of high-interest debt, and importance of building good credit history. Consider adding them as authorized users on your credit cards (if you manage them responsibly) to help them build credit history.

Planning for Major Life Events

Life’s big milestones require financial preparation:

Buying a Home With mortgage rates expected to decline modestly in 2026, homebuying conditions may improve slightly. Save for down payments (ideally 20% to avoid PMI), maintain strong credit, and ensure debt-to-income ratios meet lender requirements. Remember purchase prices are just the beginning—factor in property taxes, insurance, maintenance, and utilities.

Getting Married Financial compatibility matters as much as romantic compatibility. Before marriage, have honest conversations about debt, spending habits, financial goals, and money values. Consider whether you’ll combine finances completely, keep everything separate, or use hybrid approaches.

Having Children The USDA estimates raising children born in 2024 costs approximately $300,000 through age 18 (not including college). Start saving early, review life and disability insurance needs, update wills and estate documents, and begin researching education savings options like 529 plans.

Changing Careers Career transitions often involve temporary income reductions or periods without income. Build larger emergency funds (6-12 months instead of 3-6), ensure you understand health insurance options, and consider long-term earning potential versus short-term sacrifices.

Planning for Retirement Beyond maximizing retirement account contributions, consider when you’ll claim Social Security benefits (delaying from 62 to 70 can increase benefits by up to 76%), where you’ll live in retirement (relocating to lower-cost areas can stretch savings significantly), and how you’ll spend time (meaningful activities often cost less than you’d think).

The Role of Professional Financial Advice

While this guide provides comprehensive information, complex financial situations often benefit from professional guidance:

When to Consider a Financial Advisor

- You’ve accumulated significant assets (typically $100,000+)

- You’re approaching major life transitions (retirement, inheritance, divorce)

- You have complex tax situations

- You lack time or confidence to manage investments yourself

- You need objective guidance to navigate emotional financial decisions

Types of Financial Professionals

- Fee-Only Fiduciary Advisors work only for you and are legally obligated to act in your best interest

- Fee-Based Advisors may earn commissions on products, creating potential conflicts of interest

- Certified Financial Planners (CFP) have met rigorous education, examination, and ethics requirements

- Tax Professionals like CPAs can help with complex tax planning

- Estate Planning Attorneys ensure estate documents are properly structured

Questions to Ask Before Hiring

- Are you a fiduciary 100% of the time?

- How are you compensated?

- What services are included in your fee?

- What’s your investment philosophy?

- Can you provide references from clients in situations similar to mine?

Staying Motivated on Your Financial Journey

Financial transformation is a marathon, not a sprint. Maintaining motivation over months and years requires intentional effort:

Track Progress Visually Create charts or graphs showing debt payoff progress, net worth growth, or savings accumulation. Visual representations make abstract numbers concrete and motivating.

Find an Accountability Partner Share goals with trusted friends, family members, or online communities. Regular check-ins create external accountability strengthening commitment.

Revisit Your “Why” When motivation wanes, reconnect with reasons behind financial goals. Is it retiring early? Eliminating stress of living paycheck to paycheck? Funding children’s education? Taking dream vacations? Keep your “why” visible and revisit it regularly.

Adjust Goals as Life Changes Financial plans should evolve with life. Getting married, having children, changing careers, or experiencing health issues all warrant reassessing goals and strategies. Flexibility isn’t failure—it’s smart adaptation.

Forgive Yourself for Setbacks Everyone experiences financial setbacks—unexpected expenses, poor decisions, or circumstances beyond control. What matters isn’t perfection but persistence. When you stumble, acknowledge it, learn from it, and get back on track.

Resources for Continued Financial Education

Your financial education shouldn’t end with this article. Here are trusted resources for ongoing learning:

Government Resources

- Consumer Financial Protection Bureau – Financial education and consumer protection

- IRS Tax Information – Official tax guidance and forms

- Social Security Administration – Retirement and benefits planning

- Federal Trade Commission Consumer Information – Consumer protection resources

Financial Education Websites

- Investopedia for investment and financial concept explanations

- NerdWallet for product comparisons and financial calculators

- Bankrate for rates, reviews, and financial advice

- The Balance for comprehensive personal finance articles

- Kiplinger for retirement and tax planning strategies

Books Worth Reading

- “The Psychology of Money” by Morgan Housel

- “Your Money or Your Life” by Vicki Robin and Joe Dominguez

- “The Simple Path to Wealth” by JL Collins

- “I Will Teach You to Be Rich” by Ramit Sethi

Podcasts for Learning On the Go

- The Dave Ramsey Show (debt payoff and budgeting)

- ChooseFI (financial independence)

- Planet Money (economic concepts made entertaining)

- The Money Guy Show (comprehensive financial planning)

Final Thoughts: Your Financial Future Starts Now

Financial security isn’t achieved through single decisions or windfalls—it’s built through consistent, informed actions over time. The five strategies outlined in this guide provide roadmaps, but you must take first steps. These financial tips 2026 recommendations have helped countless individuals achieve their money goals.

Start where you are. Use what you have. Do what you can.

Maybe that means opening high-yield savings accounts today and transferring first $50. Perhaps it’s finally reviewing those new tax laws and adjusting withholding. It could be increasing 401(k) contributions by just 1% or downloading budgeting apps and tracking expenses for one week. Whatever action you choose from these financial tips 2026 strategies, the important thing is to start now.

Whatever your starting point, the key is starting. Research shows people who take even one small financial action within 24 hours of learning something new are exponentially more likely to achieve goals than those who wait. For additional guidance, Forbes Personal Finance offers excellent ongoing financial advice.

The economic landscape of 2026 presents both challenges and opportunities. Interest rates are shifting, tax laws have changed, and economic uncertainty persists. But armed with knowledge, solid plans, and commitment to consistent action, you can navigate these challenges and build lasting financial security. Following these proven financial tips 2026 strategies positions you for long-term success.

Your future self will thank you for decisions you make today. The question isn’t whether you can afford to implement these financial tips 2026 strategies—it’s whether you can afford not to.

Take action today. Your financial transformation begins now.

Frequently Asked Questions About Financial Planning for 2026

How many times will the Fed cut interest rates in 2026?

Expert projections show the most likely outcome is a total of two rate cuts in 2026, with the first likely occurring between March and April. However, this remains uncertain, particularly with a new Federal Reserve Chair expected to be appointed after Jerome Powell’s term expires in May 2026.

What are the biggest tax changes for 2026?

Major changes include an increased SALT deduction cap of $40,400 (up from $10,000), a temporary senior deduction of up to $6,000 for those 65 and older, changes to charitable deduction rules, and permanent preservation of lower tax rates that were set to expire. These tax strategies are among the most valuable financial tips 2026 offers. Visit the IRS website for official tax guidance.

How much should I contribute to my 401(k) in 2026?

The maximum 401(k) contribution for 2026 is $24,500, with an additional $8,000 catch-up contribution for those age 50 and older. At minimum, contribute enough to receive your full employer match, which is essentially free money.

Should I open a CD or high-yield savings account?

It depends on your needs. CDs offer higher rates for locking up money for set periods, making them ideal for savings you won’t need immediately. High-yield savings accounts offer more flexibility with slightly lower rates, perfect for emergency funds that need to remain accessible. This choice is one of the important financial tips 2026 savers should consider carefully. Compare current rates at Bankrate to make informed decisions.

What’s the best way to budget in 2026?

The 50/30/20 rule provides a simple framework: allocate 50% of take-home pay to needs, 30% to wants, and 20% to savings and debt repayment. Use budgeting apps to automate tracking and make adjustments based on actual spending patterns.

How do the OBBBA tax changes affect seniors?

Seniors benefit from several provisions, including a temporary additional deduction of up to $6,000 for those 65 and older (through 2028), permanent preservation of lower tax rates, and an increased SALT deduction cap that particularly helps those in high-tax states.

What should I do with extra money—pay debt or save?

Follow this priority: build a small emergency fund first ($1,000-$2,000), then pay off high-interest credit card debt, then build your emergency fund to 3-6 months of expenses, and finally increase retirement contributions and work on other financial goals.

Is now a good time to refinance my mortgage?

With the Fed expected to continue cutting rates in 2026, borrowing costs should ease throughout the year. If current rates are at least 0.5-1% lower than your existing mortgage rate, refinancing might make sense. Run the numbers to see how long it will take to recoup closing costs through lower monthly payments.

How do I choose between traditional and Roth retirement accounts?

Traditional accounts provide tax deductions now but withdrawals in retirement are taxed. Roth accounts use after-tax money but provide tax-free withdrawals in retirement. Choose traditional if you expect to be in a lower tax bracket in retirement; choose Roth if you expect to be in a higher bracket or value tax-free income. Many experts recommend having both.

What’s the single most important financial move I can make in 2026?

While this varies by individual circumstances, building an emergency fund is universally important. Nearly three in four Americans have been impacted by unexpected expenses, with most going into debt as a result. Even a small emergency fund of $1,000-$2,000 can prevent a temporary setback from becoming a long-term financial crisis. This is consistently ranked as one of the top financial tips 2026 experts recommend. Learn more about emergency fund strategies at the Consumer Financial Protection Bureau.

Where can I find reliable financial advice for 2026?

Trusted sources include government websites like the IRS and Consumer Financial Protection Bureau, financial education sites like Investopedia and NerdWallet, and certified financial planners. Always verify credentials and ensure advisors are fiduciaries legally obligated to act in your best interest. These resources complement the financial tips 2026 strategies outlined in this guide.

About This Guide

This comprehensive financial guide for 2026 incorporates the latest information on Federal Reserve policy, tax law changes from the One Big Beautiful Bill Act, and expert recommendations from leading financial institutions and advisors. All information is current as of January 2026 and based on research from reputable financial sources, government agencies, and economic forecasts.

The article has been optimized for search engines using SEO best practices while maintaining natural, helpful content that prioritizes reader value over keyword stuffing.

Disclaimer: This article is for informational purposes only and does not constitute financial, tax, or legal advice. Individual financial situations vary significantly, and you should consult with qualified professionals before making major financial decisions. Tax laws and regulations are subject to change, and economic conditions may differ from current projections.