Understanding mutual fund investing is essential for building long-term wealth in 2026. Whether you’re new to mutual fund investing or looking to optimize your mutual fund portfolio, this comprehensive guide to mutual fund investing covers everything you need about mutual funds—from mutual fund basics to advanced mutual fund investing strategies. Learn how mutual fund investing works, discover the best mutual funds for 2026, and master mutual fund investing techniques that deliver results.

Mutual fund investing remains one of the most powerful wealth-building tools available to investors. With over $80 trillion in assets under management globally, mutual fund investing provides professional management, diversification, and accessibility that individual stock picking simply cannot match. This guide explores mutual fund investing strategies, explains different types of mutual funds, and helps you choose the best mutual funds for your mutual fund investing goals.

What is Mutual Fund Investing? Understanding Mutual Funds and How Mutual Fund Investing Works

Mutual fund investing involves pooling money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. When you engage in mutual fund investing, professional fund managers handle the investment decisions, making mutual fund investing ideal for those who want expert management of their mutual fund portfolio.

How Mutual Fund Investing Actually Works

When you start mutual fund investing, you buy shares (called units) of a mutual fund. Each mutual fund share represents partial ownership of the mutual fund’s holdings. The value of your mutual fund investment changes daily based on the Net Asset Value (NAV) of the mutual fund, which is calculated by dividing the total value of all securities in the mutual fund portfolio by the number of outstanding mutual fund shares.

According to Morningstar’s mutual fund research, mutual fund investing has delivered average annual returns of 8-12% over long periods, making mutual fund investing one of the most reliable wealth-building strategies available.

Key Benefits of Mutual Fund Investing

Professional Management in Mutual Fund Investing – Expert mutual fund managers conduct research, analyze markets, and make mutual fund investment decisions on your behalf, ensuring your mutual fund investing strategy remains optimized.

Diversification Through Mutual Fund Investing – Mutual fund investing spreads your money across dozens or hundreds of securities, reducing risk compared to investing in individual stocks. This diversification is a cornerstone of smart mutual fund investing.

Liquidity in Mutual Fund Investing – Most mutual funds allow you to buy or sell mutual fund shares daily, providing excellent liquidity for your mutual fund investments. This flexibility makes mutual fund investing suitable for various financial goals.

Accessibility of Mutual Fund Investing – You can start mutual fund investing with as little as $100-$500, making mutual fund investing accessible to investors at all income levels. Fidelity Investments offers many mutual funds with no minimum investment requirements.

Transparency in Mutual Fund Investing – Mutual funds must disclose holdings regularly, ensuring you always know what your mutual fund investment contains. This transparency is crucial for informed mutual fund investing decisions.

Types of Mutual Funds: Complete Guide to Mutual Fund Categories for Mutual Fund Investing

Understanding different types of mutual funds is crucial for successful mutual fund investing. Each mutual fund category serves specific mutual fund investing objectives and offers unique mutual fund investing benefits.

Equity Mutual Funds: Growth-Oriented Mutual Fund Investing

Equity mutual funds invest primarily in stocks and are the engines of growth in mutual fund investing. These mutual funds aim for capital appreciation, making equity mutual fund investing ideal for long-term wealth building.

According to Investopedia’s mutual fund guide, equity mutual funds have historically outperformed other mutual fund types over 10+ year periods, with average returns of 10-12% annually.

Large-Cap Mutual Funds for Stable Mutual Fund Investing

Large-cap mutual funds invest in established companies with market capitalizations exceeding $10 billion. These mutual funds offer stability in your mutual fund investing strategy. Large-cap mutual fund investing is perfect for conservative investors seeking reliable mutual fund returns.

Top Large-Cap Mutual Funds for 2026:

- Vanguard 500 Index Fund (VFIAX) – Low-cost mutual fund tracking S&P 500

- Fidelity Contrafund (FCNTX) – Actively managed large-cap mutual fund

- T. Rowe Price Blue Chip Growth (TRBCX) – Growth-oriented mutual fund

Mid-Cap Mutual Funds for Balanced Mutual Fund Investing

Mid-cap mutual funds target companies valued between $2-10 billion, balancing growth potential with moderate risk in mutual fund investing. Mid-cap mutual fund investing captures companies poised for expansion.

Small-Cap Mutual Funds for Aggressive Mutual Fund Investing

Small-cap mutual funds invest in companies under $2 billion market cap, offering highest growth potential but greater volatility in mutual fund investing. Small-cap mutual fund investing suits investors with high risk tolerance and long time horizons.

Debt Mutual Funds: Conservative Mutual Fund Investing

Debt mutual funds (also called bond mutual funds or fixed-income mutual funds) invest in bonds and debt securities. Debt mutual fund investing provides stable income with lower risk than equity mutual funds.

PIMCO and Vanguard’s bond funds are leaders in debt mutual fund investing, offering diversified fixed-income mutual fund options.

Short-Term Debt Mutual Funds

Short-term debt mutual funds invest in securities maturing within 1-3 years, providing stability for near-term mutual fund investing goals. These mutual funds minimize interest rate risk in your mutual fund portfolio.

Long-Term Debt Mutual Funds

Long-term debt mutual funds hold securities maturing beyond 3 years, offering higher yields but greater sensitivity to interest rate changes in mutual fund investing.

Hybrid Mutual Funds: Balanced Mutual Fund Investing

Hybrid mutual funds (also called balanced mutual funds) combine equity and debt investments in one mutual fund portfolio. Hybrid mutual fund investing offers the growth of stocks with the stability of bonds.

According to Charles Schwab’s mutual fund research, hybrid mutual funds have grown 35% in popularity since 2024 as investors seek balanced mutual fund investing approaches.

Aggressive Hybrid Mutual Funds

Aggressive hybrid mutual funds allocate 65-80% to equities and 20-35% to debt, perfect for growth-oriented mutual fund investing with some downside protection.

Conservative Hybrid Mutual Funds

Conservative hybrid mutual funds invest 75-90% in debt and 10-25% in equity, ideal for capital preservation with modest growth in mutual fund investing.

Balanced Hybrid Mutual Funds

Balanced hybrid mutual funds maintain 40-60% in both equities and debt, offering true balance in mutual fund investing strategies.

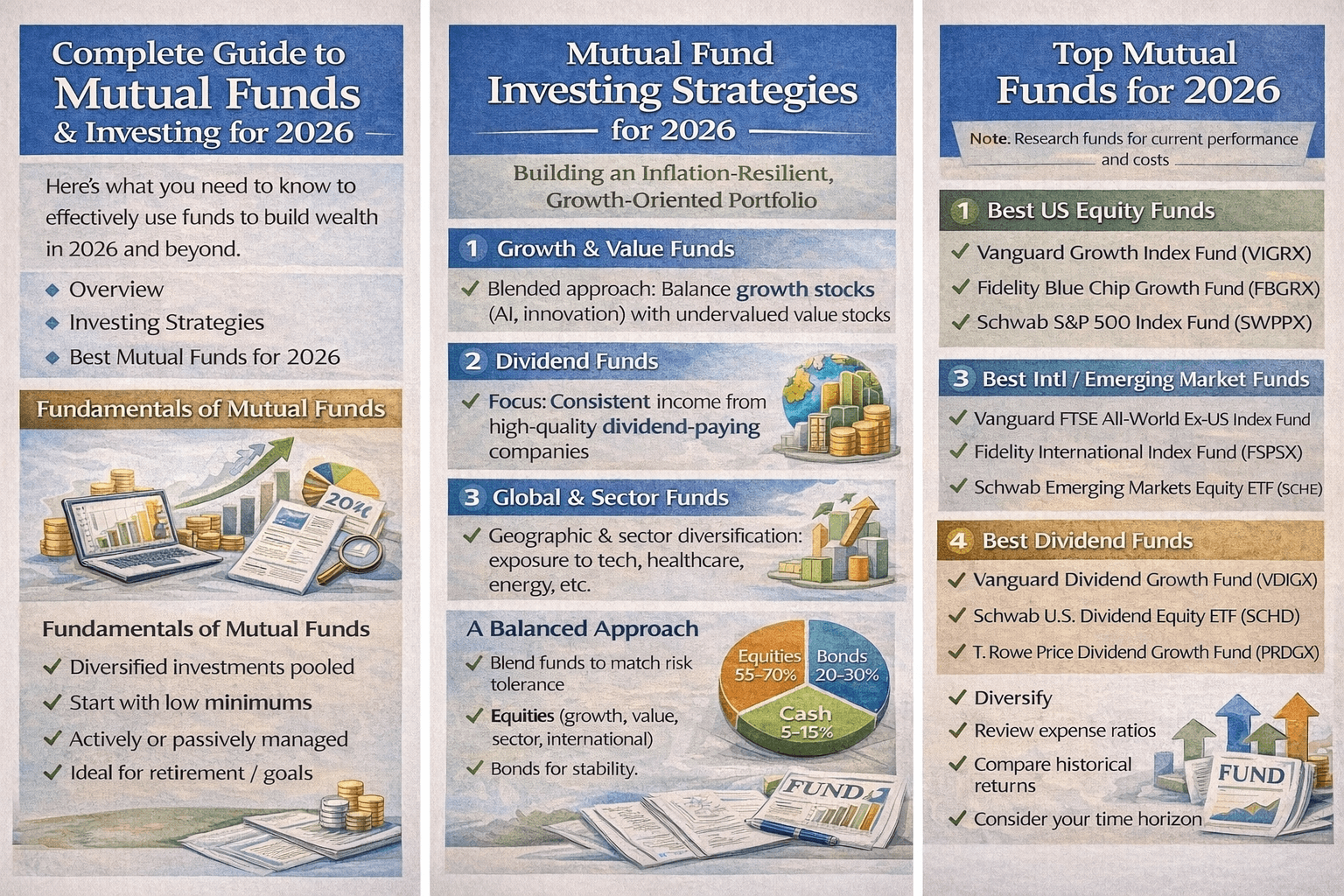

Mutual Fund Investing Strategies: How to Build the Best Mutual Fund Portfolio

Successful mutual fund investing requires strategic planning and disciplined execution. These mutual fund investing strategies help you maximize mutual fund returns while managing mutual fund risks.

SIP (Systematic Investment Plan): The Foundation of Mutual Fund Investing

SIP mutual fund investing involves investing fixed amounts regularly in mutual funds. SIP is the most popular mutual fund investing method, with over 70 million SIP accounts in India alone.

Benefits of SIP Mutual Fund Investing:

- Rupee cost averaging smooths out mutual fund price fluctuations

- Discipline in mutual fund investing builds long-term wealth

- Flexibility to start mutual fund investing with small amounts

- Power of compounding amplifies mutual fund returns over time

HDFC Mutual Fund reports that SIP mutual fund investors have achieved 12-15% average annual returns over 10-year periods.

Lump Sum Mutual Fund Investing

Lump sum mutual fund investing involves investing larger amounts at once in mutual funds. This mutual fund investing approach works best when markets are undervalued or you have significant capital to deploy in mutual funds.

Asset Allocation in Mutual Fund Investing

Asset allocation determines what percentage of your mutual fund portfolio goes into equity mutual funds versus debt mutual funds versus other mutual fund types. Proper asset allocation is crucial for successful mutual fund investing.

Age-Based Mutual Fund Asset Allocation:

| Age Group | Equity Mutual Funds | Debt Mutual Funds | Hybrid Mutual Funds |

|---|---|---|---|

| 20-35 | 70-80% | 10-20% | 10-20% |

| 35-50 | 60-70% | 20-30% | 10-20% |

| 50-60 | 40-60% | 30-40% | 10-30% |

| 60+ | 20-40% | 50-70% | 10-20% |

This mutual fund asset allocation table provides guidelines for mutual fund investing based on age and risk tolerance.

Mutual Fund Rebalancing: Essential Mutual Fund Investing Maintenance

Rebalancing your mutual fund portfolio means adjusting your mutual fund holdings to maintain target asset allocation. Regular mutual fund rebalancing is critical for disciplined mutual fund investing.

When to Rebalance Mutual Funds:

- Annually for passive mutual fund investors

- When asset allocation drifts 5%+ from targets

- After major life events affecting mutual fund investing goals

- During extreme market movements in mutual funds

Morningstar recommends rebalancing mutual fund portfolios at least annually to maintain optimal mutual fund investing strategies.

Top Mutual Funds to Invest in 2026: Best Mutual Funds Across Categories

Choosing the best mutual funds for 2026 requires analyzing mutual fund performance, mutual fund fees, mutual fund manager track records, and mutual fund alignment with your goals.

Best Equity Mutual Funds for 2026

| Mutual Fund Name | Category | Expense Ratio | 5-Year Returns | Minimum Investment |

|---|---|---|---|---|

| Vanguard Total Stock Market Index (VTSAX) | Large-Cap Blend | 0.04% | 12.4% | $3,000 |

| Fidelity Contrafund (FCNTX) | Large-Cap Growth | 0.85% | 14.2% | $0 |

| T. Rowe Price Mid-Cap Growth (RPMGX) | Mid-Cap Growth | 0.76% | 13.8% | $2,500 |

| Vanguard Small-Cap Index (VSMAX) | Small-Cap Blend | 0.05% | 11.9% | $3,000 |

| Fidelity Select Technology (FSPTX) | Technology Sector | 0.67% | 19.3% | $0 |

These mutual funds represent the best mutual fund investing options for equity growth in 2026, according to Kiplinger’s mutual fund rankings.

Best Debt Mutual Funds for 2026

| Mutual Fund Name | Category | Expense Ratio | 5-Year Returns | Minimum Investment |

|---|---|---|---|---|

| Vanguard Total Bond Market Index (VBTLX) | Intermediate Bond | 0.05% | 3.8% | $3,000 |

| PIMCO Income Fund (PONAX) | Multi-Sector Bond | 0.74% | 5.2% | $1,000 |

| Fidelity Investment Grade Bond (FBNDX) | Corporate Bond | 0.45% | 4.1% | $0 |

| Vanguard Short-Term Bond Index (VBIRX) | Short-Term Bond | 0.07% | 3.2% | $3,000 |

These debt mutual funds offer the best balance of mutual fund safety and mutual fund returns for conservative mutual fund investing in 2026.

Best Hybrid Mutual Funds for 2026

| Mutual Fund Name | Category | Expense Ratio | 5-Year Returns | Asset Allocation |

|---|---|---|---|---|

| Vanguard Balanced Index (VBIAX) | Balanced | 0.07% | 8.9% | 60% stocks/40% bonds |

| Fidelity Puritan (FPURX) | Conservative | 0.53% | 7.8% | 55% stocks/45% bonds |

| T. Rowe Price Capital Appreciation (PRWCX) | Moderate | 0.70% | 9.4% | 70% stocks/30% bonds |

| ICICI Prudential Equity & Debt Fund | Aggressive Hybrid | 1.95% | 11.2% | 75% stocks/25% bonds |

These hybrid mutual funds provide excellent balanced mutual fund investing solutions combining growth and stability.

Mutual Fund Performance Metrics: How to Evaluate Mutual Funds for Mutual Fund Investing

Analyzing mutual fund performance goes beyond simple returns. Smart mutual fund investing requires understanding multiple mutual fund metrics.

Key Mutual Fund Performance Indicators

Expense Ratio in Mutual Funds – Annual fees charged by mutual funds, expressed as percentage of assets. Lower mutual fund expense ratios mean more money stays invested for mutual fund growth.

According to Morningstar’s mutual fund expense analysis, each 1% in mutual fund fees can reduce your mutual fund wealth by 25-30% over 30 years.

Sharpe Ratio for Mutual Funds – Measures risk-adjusted mutual fund returns. Higher Sharpe ratios indicate better mutual fund performance per unit of risk taken.

Alpha in Mutual Funds – Measures how much mutual fund outperforms benchmark. Positive alpha means mutual fund manager adds value through active mutual fund investing decisions.

Beta of Mutual Funds – Measures mutual fund volatility relative to market. Mutual fund beta of 1.0 moves with market, below 1.0 is less volatile, above 1.0 more volatile.

Mutual Fund Performance Comparison Table 2026

| Metric | Equity Mutual Funds | Debt Mutual Funds | Hybrid Mutual Funds |

|---|---|---|---|

| Expected Returns | 10-15% | 4-6% | 7-10% |

| Volatility (Std Dev) | 15-20% | 2-4% | 8-12% |

| Ideal Horizon | 7+ years | 1-3 years | 3-5 years |

| Tax Efficiency | Long-term gains taxed 10%+ | Taxed as income | Varies by allocation |

| Liquidity | Daily | Daily | Daily |

This mutual fund comparison helps you choose mutual funds aligned with your mutual fund investing timeline and mutual fund risk tolerance.

Mutual Fund Investing Costs and Fees: Understanding Mutual Fund Expenses

Mutual fund costs significantly impact long-term mutual fund returns. Understanding all mutual fund fees ensures you maximize mutual fund investing profits.

Types of Mutual Fund Fees

Mutual Fund Expense Ratio – Annual mutual fund management fee covering operating costs, portfolio management, and administrative expenses of mutual funds.

- Average equity mutual fund: 0.50-1.00%

- Average bond mutual fund: 0.40-0.80%

- Index mutual funds: 0.03-0.20%

Vanguard’s research shows low-cost mutual funds consistently outperform high-cost mutual funds over time.

Mutual Fund Load Fees:

- Front-end loads: Charged when buying mutual fund shares (0-5.75%)

- Back-end loads: Charged when selling mutual fund shares (0-2%)

- No-load mutual funds: No sales charges

Impact of Mutual Fund Fees on $100,000 Investment Over 30 Years:

| Mutual Fund Expense Ratio | Final Value @ 8% Return | Total Fees Paid |

|---|---|---|

| 0.10% (Low-cost mutual fund) | $943,000 | $142,000 |

| 0.50% (Moderate mutual fund) | $806,000 | $279,000 |

| 1.00% (High-cost mutual fund) | $676,000 | $409,000 |

| 2.00% (Very high mutual fund) | $474,000 | $611,000 |

This table dramatically shows how mutual fund fees compound over time, making low-cost mutual fund investing crucial for wealth building.

Mutual Fund Investing Tax Implications: Maximizing After-Tax Mutual Fund Returns

Understanding mutual fund taxes is essential for optimizing net mutual fund returns. Mutual fund tax treatment varies by mutual fund type and holding period.

Mutual Fund Tax Treatment by Type

Equity Mutual Fund Taxation:

- Short-term gains (held < 1 year): Taxed at 15%

- Long-term gains (held > 1 year): 10% on gains exceeding $100,000 annually

Debt Mutual Fund Taxation:

- All gains taxed at your income tax slab rate

- No special long-term benefits for debt mutual funds

Hybrid Mutual Fund Taxation:

- Equity-oriented hybrid mutual funds (>65% equity): Taxed like equity mutual funds

- Debt-oriented hybrid mutual funds (<65% equity): Taxed like debt mutual funds

According to IRS mutual fund guidelines, proper mutual fund tax planning can increase after-tax returns by 1-2% annually.

Tax-Efficient Mutual Fund Investing Strategies

Hold Mutual Funds Long-Term – Reduces mutual fund tax burden through lower long-term capital gains rates in mutual fund investing.

Use Tax-Advantaged Accounts for Mutual Funds – 401(k)s, IRAs shelter mutual fund gains from annual taxation, dramatically improving mutual fund investing outcomes.

Tax-Loss Harvesting with Mutual Funds – Sell losing mutual funds to offset gains from winning mutual funds, reducing overall mutual fund tax liability.

Choose Tax-Efficient Mutual Funds – Index mutual funds generate fewer taxable events than actively managed mutual funds due to lower turnover.

Common Mutual Fund Investing Mistakes to Avoid

Even experienced investors make mutual fund investing mistakes that hurt returns. Avoid these common mutual fund pitfalls:

Mistake #1: Chasing Past Mutual Fund Performance

Buying mutual funds solely based on recent high returns often leads to poor mutual fund investing outcomes. Last year’s top-performing mutual funds frequently underperform in following years.

Morningstar studies show that only 25% of top-quartile mutual funds maintain their ranking over 5 years.

Mistake #2: Ignoring Mutual Fund Expenses

High mutual fund fees compound negatively over time. Always compare mutual fund expense ratios and choose lower-cost mutual funds when quality is similar.

Mistake #3: Over-Diversifying Mutual Funds

Owning 15-20 mutual funds creates excessive overlap without additional diversification benefits. Most investors need only 4-8 well-chosen mutual funds.

Mistake #4: Panic Selling Mutual Funds During Market Drops

Selling mutual funds during downturns locks in losses and misses recovery gains. Disciplined mutual fund investors who stay invested through volatility achieve superior long-term returns.

Mistake #5: Neglecting Mutual Fund Portfolio Rebalancing

Failing to rebalance mutual fund portfolios allows asset allocation to drift, increasing risk beyond your comfort level. Annual mutual fund rebalancing maintains intended risk/return profile.

How to Start Mutual Fund Investing: Step-by-Step Mutual Fund Investing Guide

Ready to begin mutual fund investing? Follow these steps to start building wealth through mutual funds:

Step 1: Define Your Mutual Fund Investing Goals

Clarify what you want from mutual fund investing:

- Retirement savings through mutual funds

- Child’s education fund via mutual funds

- Wealth accumulation with mutual funds

- Income generation from mutual funds

Clear mutual fund goals guide all subsequent mutual fund investing decisions.

Step 2: Determine Your Mutual Fund Risk Tolerance

Assess how much mutual fund volatility you can handle:

- Conservative: Focus on debt and balanced mutual funds

- Moderate: Mix equity and hybrid mutual funds

- Aggressive: Emphasize growth equity mutual funds

Charles Schwab’s risk assessment tool helps determine appropriate mutual fund risk level.

Step 3: Choose Mutual Fund Investment Account Type

Taxable Brokerage Accounts for Mutual Funds:

- Unlimited contributions to mutual funds

- Full mutual fund access and flexibility

- Mutual fund gains taxed annually

Tax-Advantaged Accounts for Mutual Funds:

- 401(k): Employer-sponsored retirement mutual fund investing

- IRA: Individual retirement mutual fund account

- Roth IRA: Tax-free mutual fund withdrawals in retirement

Step 4: Select the Best Mutual Fund Platform

Traditional Brokerages for Mutual Fund Investing:

- Vanguard – Best for low-cost index mutual funds

- Fidelity – Excellent mutual fund selection, no minimums

- Charles Schwab – Strong research and mutual fund tools

Robo-Advisors for Automated Mutual Fund Investing:

- Betterment – Automated mutual fund portfolio management

- Wealthfront – Tax-loss harvesting with mutual funds

Step 5: Build Your Mutual Fund Portfolio

Select mutual funds across asset classes:

- 60-80% equity mutual funds for growth

- 20-30% debt mutual funds for stability

- 0-20% international mutual funds for global exposure

Step 6: Implement Your Mutual Fund Investing Strategy

Start SIP in Mutual Funds – Automate monthly mutual fund investments Monitor Mutual Fund Performance – Review mutual fund quarterly, rebalance annually Stay Disciplined with Mutual Funds – Ignore short-term mutual fund market noise

Mutual Fund Investing for Different Life Stages

Optimal mutual fund strategies evolve throughout life. Tailor mutual fund investing to your current life stage:

Mutual Fund Investing in Your 20s and 30s

Aggressive Growth Mutual Funds dominate portfolios:

- 80% equity mutual funds (large, mid, small-cap mix)

- 10% international mutual funds

- 10% debt mutual funds

Time horizon allows recovering from mutual fund volatility while maximizing mutual fund compound growth.

Mutual Fund Investing in Your 40s and 50s

Balanced Mutual Fund Approach:

- 60-70% equity mutual funds

- 20-30% debt mutual funds

- 10% hybrid mutual funds

Maintain mutual fund growth while gradually reducing mutual fund portfolio risk.

Mutual Fund Investing in Your 60s and Beyond

Capital Preservation with Mutual Fund Income:

- 30-40% equity mutual funds (large-cap, dividend-focused)

- 50-60% debt mutual funds (short to intermediate-term)

- 10% hybrid conservative mutual funds

Preserve mutual fund capital while generating steady mutual fund income for retirement.

Future of Mutual Fund Investing: Trends Shaping Mutual Funds in 2026 and Beyond

The mutual fund industry continues evolving. Understanding these mutual fund trends helps you adapt your mutual fund investing strategy:

ESG Mutual Fund Investing Growth

Environmental, Social, and Governance (ESG) mutual funds have exploded in popularity. ESG mutual fund assets exceeded $3 trillion globally in 2025, with projections reaching $5 trillion by 2028.

Morningstar’s ESG mutual fund research shows ESG mutual funds matching or exceeding traditional mutual fund returns while aligning with investor values.

AI-Powered Mutual Fund Management

Artificial intelligence is transforming mutual fund portfolio management, with AI-enhanced mutual funds using machine learning to identify investment opportunities and manage risk more effectively.

Low-Cost Index Mutual Fund Dominance

Index mutual funds and ETFs continue gaining market share from actively managed mutual funds. Over 50% of U.S. equity mutual fund assets now reside in passive index strategies.

Sustainable and Impact Mutual Fund Investing

Impact mutual funds that deliberately generate measurable social/environmental benefits alongside financial returns represent the fastest-growing mutual fund segment.

Frequently Asked Questions About Mutual Fund Investing

What is the best mutual fund for beginners in mutual fund investing?

For beginning mutual fund investors, broad-market index mutual funds like Vanguard Total Stock Market Index (VTSAX) or Fidelity Total Market Index (FSKAX) provide excellent diversification, low costs, and simplicity. These mutual funds offer complete U.S. stock market exposure in one mutual fund, making them perfect for learning mutual fund investing basics. Visit Vanguard or Fidelity to open accounts and start mutual fund investing.

How much money do I need to start mutual fund investing?

You can start mutual fund investing with as little as $100-$500 for most mutual funds, and some mutual funds have no minimum investment requirement. Fidelity mutual funds offer many zero-minimum mutual fund options, while Vanguard mutual funds typically require $1,000-$3,000 initial mutual fund investments. SIP (Systematic Investment Plan) mutual fund investing allows starting with even smaller amounts monthly.

Are mutual funds better than stocks for investing?

Mutual funds offer diversification, professional management, and lower risk than individual stocks, making mutual fund investing ideal for most investors. However, mutual funds charge fees and may underperform the market. Many investors use mutual funds as their core holdings while adding individual stocks for potential outperformance. Investopedia’s comparison provides detailed mutual fund versus stock analysis.

What returns can I expect from mutual fund investing?

Historical mutual fund returns vary by type: equity mutual funds average 10-12% annually, debt mutual funds 4-6%, and hybrid mutual funds 7-10%. However, past mutual fund performance doesn’t guarantee future mutual fund returns. According to Morningstar mutual fund data, long-term mutual fund investing (10+ years) significantly increases the probability of positive returns.

How are mutual funds taxed?

Mutual fund taxation depends on mutual fund type and holding period. Equity mutual funds held over 1 year face 10% long-term capital gains tax on profits exceeding $100,000 annually. Short-term mutual fund gains are taxed at 15%. Debt mutual funds are taxed at your income tax slab rate. Consult IRS mutual fund guidelines or a tax professional for specific mutual fund tax situations.

Should I invest in mutual funds through SIP or lump sum?

SIP mutual fund investing works better for most investors because it averages costs, enforces discipline, and reduces timing risk in mutual fund investing. Lump sum mutual fund investing may outperform if markets rise consistently, but timing markets is difficult. HDFC Mutual Fund research shows SIP mutual fund investors achieve better risk-adjusted returns over time.

How many mutual funds should I own?

Most investors need only 4-8 mutual funds for adequate diversification: 2-3 equity mutual funds (large, mid, small-cap), 1-2 debt mutual funds, 1 international mutual fund, and optionally 1 hybrid mutual fund. Owning too many mutual funds creates overlap without additional benefits. Morningstar recommends focusing on quality over quantity in mutual fund selection.

What is the difference between mutual funds and ETFs?

Both mutual funds and ETFs offer diversification and professional management. Key differences: mutual funds trade once daily at NAV, while ETFs trade throughout the day like stocks. ETFs typically have lower expense ratios than mutual funds but may incur trading commissions. Mutual funds allow automatic investing and fractional shares more easily. Charles Schwab’s comparison details mutual fund versus ETF differences.

Can I lose money in mutual fund investing?

Yes, mutual funds can lose value, especially equity mutual funds during market downturns. However, diversification in mutual funds reduces risk compared to individual stocks. Long-term mutual fund investing (5+ years) historically has positive returns despite short-term mutual fund volatility. Never invest money in mutual funds that you’ll need within 1-3 years.

How do I choose the best mutual fund?

Choose mutual funds by evaluating: consistent long-term performance (3-5+ years), low expense ratios (under 1%), experienced fund managers, alignment with your goals and risk tolerance, and strong risk-adjusted returns (high Sharpe ratio). Use Morningstar mutual fund ratings and NerdWallet’s mutual fund comparison tools to research mutual funds.

Conclusion: Start Your Mutual Fund Investing Journey Today

Mutual fund investing provides one of the most accessible, diversified, and professionally managed paths to building long-term wealth. Whether you’re just beginning mutual fund investing or optimizing an existing mutual fund portfolio, the principles remain the same: understand your goals, choose appropriate mutual funds, keep costs low, diversify across mutual fund types, and maintain discipline through market cycles.

The best time to start mutual fund investing was yesterday; the second-best time is today. Begin with small, regular mutual fund investments through SIP, gradually building your mutual fund knowledge and portfolio. As your understanding of mutual fund investing deepens, you can refine your mutual fund strategy and potentially add more sophisticated mutual fund holdings.

Remember, successful mutual fund investing is a marathon, not a sprint. The power of compound growth in mutual funds rewards patient, disciplined investors who stay committed to their mutual fund investing plan through both bull and bear markets. Start your mutual fund investing journey today, and let the proven wealth-building power of mutual funds work for your financial future.

For more information on mutual fund investing, visit authoritative resources like Morningstar, Vanguard, Fidelity, and Investopedia.